Introduction

Exchange-Traded Funds (ETFs) have revolutionized the investment landscape, offering investors a balanced combination of diversification, price-efficiency, and liquidity. Among the plethora of financial sources available these days, fintechzoom.com ETF market stands proud as a hub for distinct insights, analysis, and steerage on ETF investments. If you’ve ever felt overwhelmed navigating the complexities of the ETF international, you’re not alone—however with the proper tools and knowledge, success is inside reach. This blog delves into the dynamic world of ETFs, unraveling their potential, and showcasing how Fintechzoom empowers traders to make knowledgeable selections. Whether you’re a pro investor or simply beginning your journey, this is the closing guide to knowledge and navigating the ETF market with self assurance.

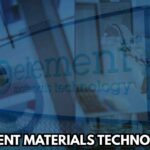

The Growing Popularity of ETFs

ETFs have reshaped the investment landscape by means of combining the excellent components of mutual finances and stocks. These funds will let you put money into a diverse range of property, from equities and bonds to commodities and opportunity investments, at some stage in a single product. Unlike conventional mutual price range, ETFs exchange on inventory exchanges, making them handy and bendy.

At fintechzoom.com ETF market, investors gain get right of entry to to comprehensive tools and analytics, helping them examine overall performance metrics, track market trends, and uncover hidden opportunities. This strong aid makes it less complicated than ever to capitalize at the benefits of ETFs, empowering customers to construct portfolios that align with their desires.

Why Choose ETFs for Your Portfolio?

The appeal of ETFs lies in their simplicity and value-efficiency. With decrease fee ratios as compared to mutual price range and the potential to trade intraday like shares, ETFs have speedy come to be a desired choice for investors. The fintechzoom.com ETF market gives distinct publications on selecting ETFs that fit your risk tolerance, funding horizon, and financial desires.

Moreover, ETFs offer immediately diversification. For example, making an investment in a single ETF could provide exposure to hundreds or maybe thousands of man or woman securities. Fintechzoom simplifies this technique, breaking down the composition and overall performance of ETFs, ensuring investors have a clean picture of what they’re buying.

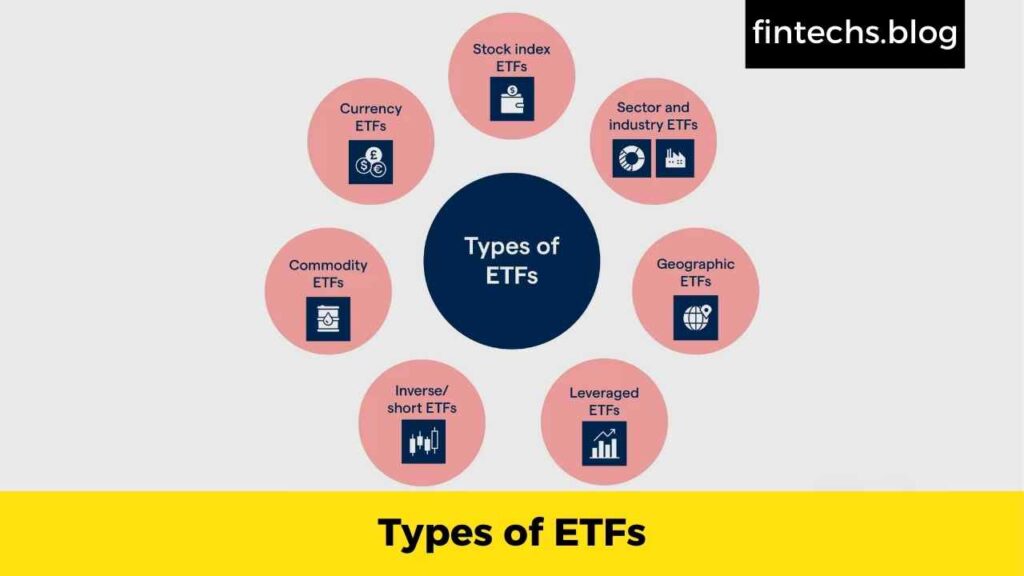

Types of ETFs

Navigating the ETF landscape can sense daunting due to the sheer range to be had. From fairness ETFs and stuck-profits ETFs to area-unique finances and thematic ETFs, the options are virtually infinite. Fintechzoom excels in categorizing and reviewing these ETFs, helping you discover which ones align with your funding dreams.

For example, thematic ETFs cognizance on precise developments like renewable energy or artificial intelligence. These niche investments are more and more popular among younger buyers seeking to align their portfolios with their values. The fintechzoom.com ETF market affords in-intensity analyses of such trends, supporting customers stay ahead in this rapidly evolving area.

How Fintechzoom Empowers ETF Investors

Understanding the market is the cornerstone of a hit investing, and fintechzoom.com ETF market serves as a useful ally in this journey. The platform gives actual-time updates on ETF overall performance, breaking news that impacts the financial international, and professional remark on rising trends.

One standout feature is its academic content, which caters to all experience tiers. Beginners can examine the fundamentals of ETFs, even as seasoned buyers can discover superior strategies like leveraging or shorting ETFs. This all-encompassing technique ensures that every tourist leaves the platform higher ready to make sound investment decisions.

Benefits of Using Fintechzoom for ETF Research

One of the finest blessings of Fintechzoom is its user-pleasant interface. The platform organizes records intuitively, making it clean to locate what you’re searching out. Whether you’re inquisitive about a selected ETF’s historic overall performance or looking for recommendation on constructing a assorted portfolio, the fintechzoom.com ETF market has you blanketed.

Moreover, the platform emphasizes transparency. Detailed breakdowns of ETF prices, underlying belongings, and hazard profiles enable traders to make selections with self assurance. This is mainly precious in a market in which hidden prices and complex jargon often confuse newcomers.

ETF Market Trends to Watch

The ETF marketplace is continuously evolving, and staying informed is vital. Some of the important thing trends gaining traction encompass sustainable making an investment, smart beta ETFs, and the upward thrust of actively controlled ETFs. Fintechzoom maintains investors up to date on those tendencies, offering actionable insights that assist users adapt their strategies.

For example, sustainable ETFs recognition on businesses with strong environmental, social, and governance (ESG) practices. As call for for moral investments grows, these ETFs are getting a cornerstone of many portfolios. Fintechzoom specific ESG reviews make certain you’re investing in price range that clearly align along with your values.

Also Read: FintechZoom.com Crypto Mining: Tips & Insights 2025

Conclusion

ETFs have undoubtedly revolutionized the investment world, offering a perfect balance of simplicity, flexibility, and cost-effectiveness. With the guidance and resources available on fintechzoom.com ETF market, investors are better equipped to navigate the complexities of the ETF landscape and make decisions with confidence. Whether you’re exploring thematic ETFs, diving into ESG-focused funds, or looking for ways to diversify your portfolio, Fintechzoom provides the tools, insights, and strategies to succeed. Your financial goals are within reach, and the journey starts with informed choices—begin your ETF exploration with Fintechzoom today!

FAQ About FintechZoom.com ETF Market

Q1: What is market cap for ETF?

Ans: Market cap for an ETF refers to the total value of all its underlying assets, reflecting the size of the companies or assets within the fund. It helps categorize ETFs as large-cap, mid-cap, or small-cap. This metric aids investors in aligning their portfolios with specific market segments.

Q2: How do ultrashort ETFs work?

Ans: Ultrashort ETFs aim to deliver the opposite return of their benchmark index, often using leverage to amplify daily performance. They are designed for short-term trades rather than long-term investments. These funds are ideal for experienced investors hedging risks or speculating on market declines.

Q3: What is the 70/30 rule ETF?

Ans: The 70/30 rule in ETFs represents a portfolio allocation of 70% equities and 30% bonds, balancing growth and stability. It is a common strategy for moderate-risk investors seeking diversification. This allocation can be achieved through balanced ETFs or a mix of funds.

Q4: What is the downside to an ETF?

Ans: ETFs can carry risks like market volatility, liquidity issues, and tracking errors. Some specialized or niche ETFs may be less diversified, increasing risk exposure. Additionally, frequent trading of ETFs can lead to higher costs and tax implications.

Q5: What is the 30-day rule on ETFs?

Ans: The 30-day rule, known as the wash-sale rule, prohibits investors from claiming a tax loss if they repurchase the same or a substantially identical ETF within 30 days. It aims to prevent tax-loss harvesting abuse. Adherence to this rule is essential to avoid penalties.

Q6: How do ETFs work for beginners?

Ans: ETFs allow beginners to invest in a diversified portfolio of assets by purchasing shares traded on stock exchanges. They offer flexibility, lower costs, and transparency compared to mutual funds. Beginners can start with broad-market ETFs for simple and effective exposure.