Introduction

The DAX 40 index is a cornerstone of the German and European markets, reflecting the health and stability of Europe’s largest economy. Known for its industrial giants like BMW, SAP, and Siemens, the DAX 40 provides investors with access to Germany’s economic pulse across a wide range of sectors. Since expanding from 30 to 40 companies, this index offers a more comprehensive snapshot of Germany’s economic drivers, drawing interest from global investors looking to diversify their portfolios with some of the continent’s most influential firms. For anyone curious about how the fintechzoom.com DAX40 works and what it can mean for their investment strategy, fintechzoom.com offers an accessible, real-time platform to track movements and explore opportunities in Germany’s leading index.

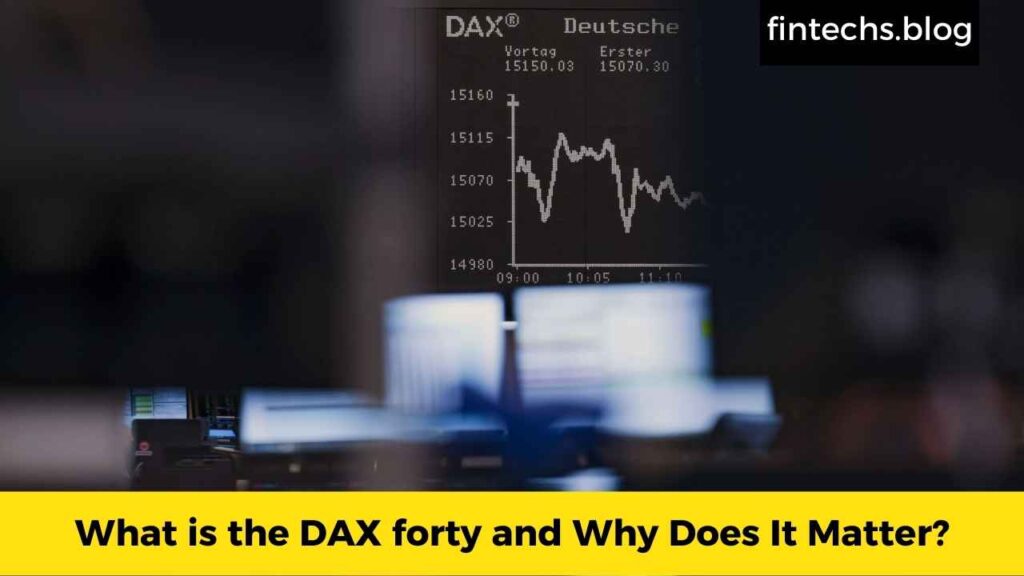

What is the DAX forty and Why Does It Matter?

The DAX forty, frequently highlighted on fintechzoom.com DAX40, is Germany’s leading stock index, representing the us of a’s biggest and most influential corporations. Originally the DAX 30, this index expanded to encompass forty organizations in 2021, supplying a broader mirrored image of Germany’s economic panorama. This index acts as a important benchmark not most effective for German traders but also for those around the arena looking European marketplace developments.

Investors flip to the DAX forty as a gauge for the health of each Germany’s economic system and the wider Eurozone, because it includes sectors from automobile to prescription drugs. By know-how this index, investors can gain insights into marketplace movements and broader monetary fitness, giving them a tremendous part. With fintechzoom.Com, tracking those modifications has turn out to be greater available for international investors.

The Evolution of DAX: From 30 to 40 Companies

The evolution from DAX 30 to DAX forty changed into a vital shift. This enlargement in 2021 changed into meant to boom the index’s resilience and higher represent the current German financial system. Now, fintechzoom.Com’s evaluation of the DAX 40 gives a more complete view of Germany biggest company gamers, reflecting the stability and diversity of its commercial and economic landscape.

For traders, this change indicates a more balanced and inclusive approach, as the added businesses come from various sectors, along with generation and healthcare. This alternate allows fintechzoom.Com users to diversify their portfolios with a more massive range of German stocks, keeping them updated on important marketplace trends.

Key Sectors Represented inside the DAX forty

Fintechzoom.Com DAX40 includes companies from diverse essential sectors, making it a nicely-rounded index. Core sectors like car, finance, technology, prescription drugs, and chemicals dominate this index, underscoring Germany’s business powerhouses. Automotive giants like BMW and Mercedes-Benz Group lead the price, complemented by pharmaceutical businesses which include Bayer.

By following fintechzoom.Com’s analysis of these sectors, investors can understand how every one contributes to the German financial system and, with the aid of extension, to the DAX 40’s performance. This quarter variety is critical for traders trying to live knowledgeable approximately the resilience and adaptableness of the German market.

How DAX 40 Reflects Germany Economic Health

The DAX forty is a sturdy indicator of Germany’s financial energy, and via extension, a pulse check for the wider European marketplace. When you discover fintechzoom.Com updates on DAX forty actions, you get a glimpse of the way predominant corporations perform below various monetary situations, imparting a real-time economic barometer.

Given Germany’s role as Europe’s financial powerhouse, changes within the DAX forty can effect different European indices. This is why many buyers follow fintechzoom.Com closely, as DAX fluctuations can sign broader economic trends and help traders make knowledgeable economic selections within the European market.

How to Invest in the DAX forty on Fintechzoom.Com

For the ones keen to invest in the fintechzoom.com DAX40 presents a wealth of sources, from professional insights to actual-time marketplace updates. One popular way to make investments is thru Exchange-Traded Funds (ETFs) that track the DAX 40, permitting investors to shop for stocks representing the index with out shopping person shares. This technique gives simplicity and diversification.

Another approach is to pick particular DAX 40 agencies to put money into, specifically if an investor has a selected industry preference. Fintechzoom.Com’s information makes it clean to research man or woman corporations inside the DAX, helping investors decide which stocks align high-quality with their dreams and chance tolerance.

Key Benefits of Investing in DAX forty

The DAX forty gives numerous benefits to investors, making it a famous choice on fintechzoom.Com. First, making an investment in the DAX 40 manner investing in the balance of Germany’s economic system, with sectors like automobile, healthcare, and technology. These industries commonly show off solid growth, giving traders a rather secure and profitable investment street.

Furthermore, DAX 40 numerous area illustration gives a stage of danger reduction. Investors can diversify their portfolios through gaining exposure to various industries, reducing the effect of quarter-particular downturns. Following fintechzoom.com can help traders stay up to date on DAX40 overall performance and maximize those blessings.

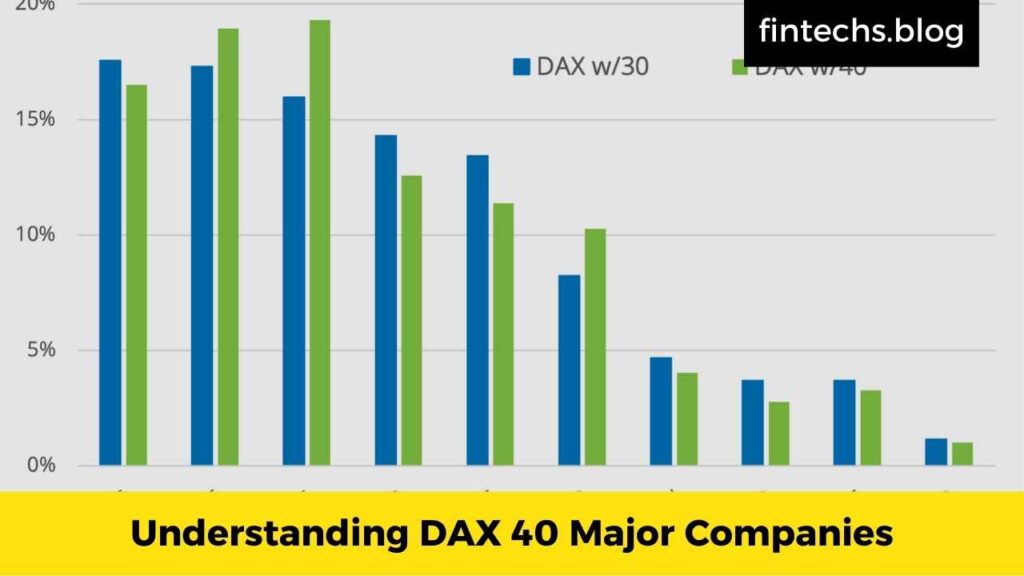

Understanding DAX 40 Major Companies

The DAX 40 index is domestic to some of the maximum influential businesses in Europe, inclusive of Siemens, Deutsche Bank, and SAP. These agencies play a enormous function of their respective industries and contribute to Germany’s robust financial panorama. Fintechzoom.Com’s special company analyses provide insights into how these agencies impact the index’s overall performance.

Investors gain from preserving a watch on these leading corporations due to the fact their performance often units the tone for the whole index. For instance, whilst SAP plays well, it is able to boost the era area’s contributions to the DAX, that is why fintechzoom.Com affords in-depth analyses of individual stocks in the index.

Factors Affecting DAX 40 Performance

The DAX forty is prompted through different factors, each domestic and global. Economic rules, shifts in worldwide exchange, foreign money fluctuations, or even geopolitical tensions play a role inside the index’s performance. By checking fintechzoom.Com’s updates, investors can monitor those elements and anticipate market tendencies.

Additionally, financial facts like GDP increase, inflation quotes, and employment figures in Germany impact the DAX forty. Keeping up with fintechzoom.Com’s insights can assist traders apprehend how these factors effect Germany’s economic outlook and the DAX 40’s normal overall performance, helping them make timely and informed investment selections.

Comparing DAX forty with Other Major Indices

When it involves global indices, the DAX 40 stands along giants just like the S&P 500, FTSE one hundred, and Nikkei 225. Each index represents the economic power of its respective location, and fintechzoom.Com offers valuable comparisons to expose how DAX 40 stacks up. While the S&P 500 is understood for its tech and finance dominance, DAX 40 is famend for industrial power and automobile prowess.

For traders, these comparisons are useful in identifying the way to allocate funds globally. By exploring fintechzoom.Com’s pass-index analysis, traders can determine which markets align quality with their techniques and discover unique advantages in the DAX 40.

Common Risks in DAX 40 Investment

Investing within the DAX 40 comes with dangers, as it’s suffering from international economic uncertainties, forex dangers, and quarter-unique downturns. For instance, Germany’s reliance on exports makes the DAX 40 prone to global exchange dynamics. Fintechzoom.Com facilitates buyers stay up to date on those ability dangers to mitigate losses.

Another hazard is sector dependency; for the reason that DAX 40 includes several automotive and production companies, any enterprise slowdown can impact the index drastically. Fintechzoom.Com’s updates keep investors knowledgeable, offering proactive insights on managing these dangers and making strategic funding choices.

Analyzing DAX 40 Recent Performance on Fintechzoom.Com

Recent overall performance traits within the DAX forty display lots about the cutting-edge financial weather in Germany and Europe. Fintechzoom.Com DAX40 analyses of quarterly or annual performances offer a image of boom trends or slowdowns, vital for traders monitoring market changes.

As the worldwide market recovers from disruptions, fintechzoom.Com facilitates traders gauge how the DAX 40 is faring compared to other indices. This ongoing performance evaluation supports traders in refining their techniques and spotting possibilities in the DAX 40 index.

Also Read: FintechZoom.com Bitcoin Price Today: Real Time Updates 2024

Conclusion

The DAX 40 is more than just a stock index; it’s a reflection of Germany’s industrial strength and economic vitality. By including top players across automotive, technology, pharmaceuticals, and finance, it provides a diverse range of opportunities for investors looking to gain exposure to Europe’s strongest economy. Fintechzoom.com makes following the DAX 40 easy, with up-to-date market insights, company analyses, and tools for tracking trends that matter.

Whether you’re a seasoned investor or new to European markets, understanding the fintechzoom.com DAX40 guidance can open up valuable perspectives and help you make more informed decisions. With the DAX 40 balanced mix of stability and innovation, this index remains a smart choice for long-term investors aiming to benefit from the resilience and growth of Germany’s economic landscape.

FAQ About Fintechzoom.Com Dax40

Q1: How can I invest in DAX 40?

Ans: You can invest in DAX 40 through ETFs that track the index or by purchasing shares of individual companies within the DAX. Many online brokers offer access to these options.

Q2: Which country created the Xetra DAX?

Ans: Germany created the Xetra DAX, with the Frankfurt Stock Exchange managing the index. It’s one of the most important indexes in Europe.

Q3: What does DAX 40 represent?

Ans: The DAX 40 represents Germany’s top 40 largest and most liquid companies, spanning sectors like automotive, finance, technology, and healthcare.

Q4: Is the DAX 40 different from the DAX 30?

Ans: Yes, the DAX expanded from 30 to 40 companies in 2021 to better reflect the German economy’s diversity and include more sectors.

Q5: What sectors are covered in DAX 40?

Ans: DAX 40 covers various sectors, including automotive, healthcare, technology, and financial services, offering a balanced view of Germany’s economic strengths.

Q6: How often is the DAX 40 updated?

Ans: The DAX 40 is updated in real time during trading hours, with reviews of its composition conducted twice a year to ensure relevance.